Introduction

An Initial Public Offering (IPO) is a significant event for a company and investors. It marks the first time a company offers its shares to the public, allowing it to raise capital for expansion, debt repayment, or other corporate purposes. For investors, an IPO presents an opportunity to invest in a company at an early stage, potentially reaping substantial rewards. In India, the IPO market has been vibrant, attracting both retail and institutional investors. This blog will explore the intricacies of IPOs, the process of applying for them, and a recent example to illustrate the concept.

What is an IPO?

An IPO, or Initial Public Offering, is the process by which a private company offers its shares to the public for the first time. This transition from a privately-held entity to a publicly-traded company is a crucial step in a company’s lifecycle. By going public, a company can access a broader pool of capital, enhance its market visibility, and provide liquidity to its shareholders.

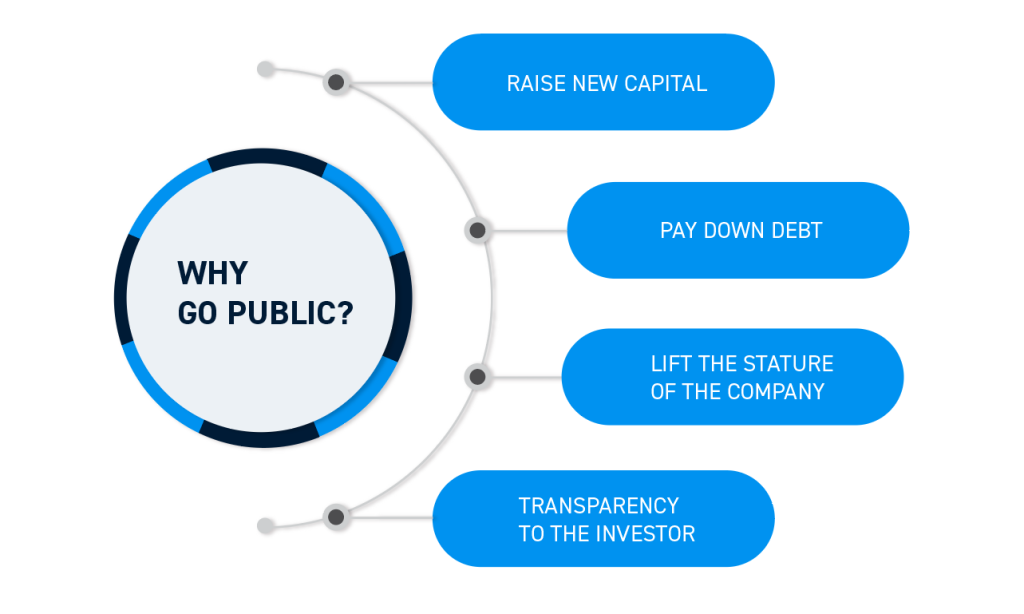

Why Do Companies Go Public?

- Capital Raising: An IPO allows a company to raise substantial capital, which can be used for expansion, debt reduction, or other business objectives.

- Increased Visibility: Public companies often gain higher visibility, which can enhance their brand and reputation.

- Liquidity for Shareholders: Existing shareholders, including founders and early investors, can sell their shares in the open market, providing liquidity.

- Valuation Benchmark: The IPO sets a market-driven valuation for the company, which can be used as a benchmark for future fundraising.

The IPO Process in India

- Pre-IPO Preparations:

- Appointing Advisers: Companies hire investment banks, underwriters, legal experts, and auditors to assist in the IPO process.

- Drafting Prospectus: A draft prospectus, known as the Draft Red Herring Prospectus (DRHP), is prepared and submitted to SEBI. This document contains detailed information about the company’s financials, business model, risks, and plans for the raised funds.

- SEBI Approval:

- SEBI reviews the DRHP and may request modifications or additional disclosures. Once satisfied, SEBI gives its approval for the IPO.

- Pricing and Lot Size:

- The company, along with its underwriters, determines the price band and the minimum lot size for investors. The price band represents the range within which the final price will be decided.

- Bidding Process:

- The IPO is open for a few days during which investors can place their bids. The bidding process can be categorized into three categories:

- Qualified Institutional Buyers (QIBs): Includes mutual funds, banks, and other institutional investors.

- Non-Institutional Investors (NIIs): Includes high-net-worth individuals.

- Retail Individual Investors (RIIs): Retail investors with a maximum bid amount of ₹2 lakhs.

- The IPO is open for a few days during which investors can place their bids. The bidding process can be categorized into three categories:

- Allotment of Shares:

- Once the bidding process is closed, the final issue price is determined based on the demand. Shares are allotted to investors according to the subscription levels in each category.

- Listing on Stock Exchange:

- The shares are then listed on the stock exchanges, and trading begins. The listing day is crucial as it determines the market’s reaction to the company’s public debut.

How to Apply for an IPO in India

- Eligibility:

- To apply for an IPO, an investor must have a demat account and a trading account with a registered stockbroker.

- Application Process:

- Online Application: Most investors prefer applying online through the broker’s trading platform or mobile app. They can select the IPO, enter the number of shares and bid price, and submit their application.

- UPI Mandate: Retail investors can use the Unified Payments Interface (UPI) for payments. Upon submitting the bid, the investor receives a mandate request on their UPI app, which they need to approve.

- ASBA (Application Supported by Blocked Amount): Another method is applying through ASBA, where the bid amount is blocked in the investor’s bank account until the allotment process is completed. This method is available through net banking.

- Bidding:

- Investors can bid within the price band set by the company. It is advisable to bid at the upper end of the price band to increase the chances of allotment.

- Allotment Status:

- Investors can check the allotment status on the registrar’s website or through their broker’s platform. If shares are allotted, they are credited to the demat account. In case of non-allotment, the blocked funds are released.

- Listing and Selling:

- On the listing day, the shares start trading on the stock exchange. Investors can sell the shares if they wish to book profits or hold them for long-term gains.

Key Considerations for Investors

Company Research: Before applying for an IPO, thoroughly research the company’s business model, financial health, and growth prospects. The DRHP and other financial reports provide valuable insights.

Market Conditions: The overall market sentiment can influence IPO performance. It is essential to consider market conditions before investing.

Valuation: Analyze the company’s valuation and compare it with its peers. An overpriced IPO may not yield desired returns.

Risk Factors: Every investment carries risks. Be aware of the potential risks associated with the company and the sector it operates in.

Long-term vs. Short-term: Determine your investment horizon. IPOs can offer quick gains on listing, but some companies may require a long-term perspective for substantial returns.

Conclusion

Participating in an IPO can be a rewarding experience for investors, offering opportunities to be part of a company’s growth journey. However, it is crucial to approach IPO investments with careful research and due diligence. By understanding the process and evaluating the company’s fundamentals, investors can make informed decisions and potentially benefit from the exciting prospects that IPOs offer in the Indian stock market.

“Frequently Asked Questions (FAQs) About How to Start an Import-Export Business in India”

What is an IPO?

An IPO, or Initial Public Offering, is the process by which a private company offers its shares to the public for the first time. This transition allows the company to raise capital from public investors.

Why do companies go public with an IPO?

Companies go public to raise capital for expansion, pay off debts, or improve their financial stability. It also allows early investors to monetize their investments and can increase the company’s visibility and credibility.

How can individual investors apply for an IPO in India?

Investors can apply for an IPO through online banking (ASBA), brokerage firms, or trading apps. They need a demat account, a PAN card, and a bank account to participate.

What is the difference between an IPO and an FPO?

An IPO is the first sale of shares to the public, while a Follow-on Public Offering (FPO) is an additional issuance of shares after the company has already gone public.

How is the IPO price determined?

The IPO price is determined through a process called book-building, where the company sets a price band and investors bid within this range. The final price is set based on demand and supply.

What is the lock-in period in an IPO?

The lock-in period refers to the duration during which certain investors, such as promoters and institutional investors, cannot sell their shares. In India, it is typically 30 days for retail investors and up to three years for promoters.

What are the risks of investing in an IPO?

Investing in an IPO carries risks such as market volatility, lack of historical data, and the possibility of the stock price falling below the IPO price post-listing.

What is the role of SEBI in an IPO?

The Securities and Exchange Board of India (SEBI) regulates IPOs in India. It ensures that companies provide accurate and comprehensive information to investors and adhere to regulatory norms.

Can an IPO application be canceled?

Yes, investors can cancel or withdraw their IPO applications during the bidding period, typically before the closing date of the IPO.

How are IPO shares allocated to investors?

IPO shares are allocated based on demand and category-wise quota. For oversubscribed IPOs, shares may be allotted on a pro-rata or lottery basis, depending on the allocation method.

What is a ‘grey market’ in the context of IPOs?

The grey market is an unofficial market where IPO shares are traded before their official listing. The grey market premium (GMP) can indicate market sentiment towards the IPO.

How can investors track the performance of an IPO?

Investors can track an IPO’s performance by monitoring its listing on stock exchanges, reading company updates, and following market news and analysis.

What should investors consider before investing in an IPO?

Investors should consider the company’s financials, business model, growth prospects, industry trends, and the overall market environment before investing in an IPO.